- What is diversification?

- Why is it important to diversify your bonds?

- How to diversify your bonds?

Are you looking forward to making your investment safe & successful? Someone must have advised you to diversify your selection of investment. Or you might have seen the portfolios of expert investors. And now you’re confused about how it can help you grow. Before entering a trade market, you must be aware of the terms crucial for your investment.

If you clear everything before stepping into trade, there will be more possibility of getting higher profit. Not only profit, but it will catalyze your success process too. So, the point is ‘what is meant by diversification of bonds?’ No more ambiguities because you’re on the right page now. We’ll guide you through this process in a comprehensive way.

What is diversification?

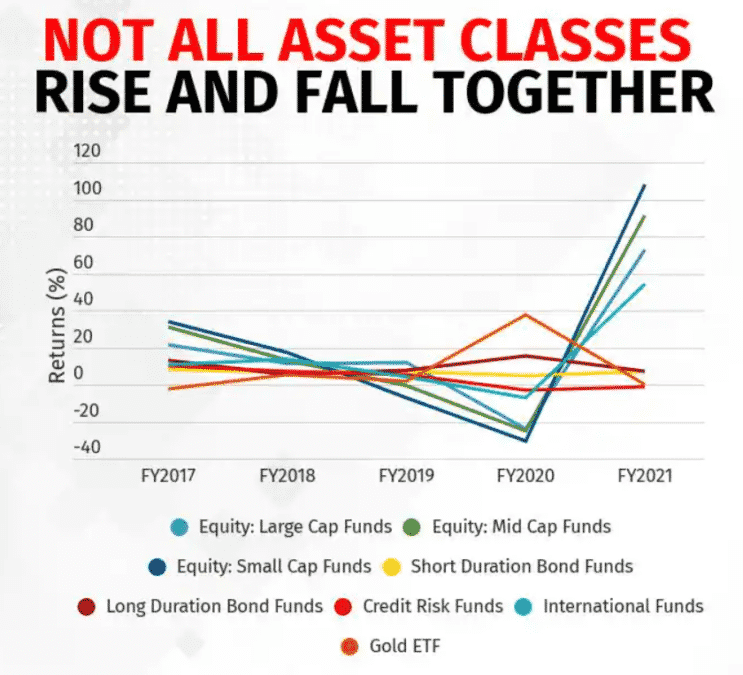

As the term itself reveals, it’s about spreading your investment. In trading language, diversification means expanding your investment to various sectors or assets. It is a strategy to lessen the exposure of your investment to a particular class of market. By using the technique of diversification, you make your portfolio a mix of investments. For example, by diversification of bonds, you are buying a variety, unreasonable which, in turn, reduces the risks of losing your hard-earned money all at once.

Why is it important to diversify your bonds?

Do you remember the proverb “don’t put all your eggs in one basket”? Well, have you acknowledged that this quote is not only applicable to farmers? This saying is a perfect definition of diversification. If a farmer puts his eggs in different baskets, if the eggs of one basket break, the eggs in other baskets will be safe & sound.

The same goes for trading; diversification neutralizes the loss in one class. The loss in one investment will be compensated from another source. There’ll be lesser risks as you won’t lose your whole wealth by declining a single product. In this way, you develop an equilibrium state in your profit & loss risks level.

Diversification in bonds comes with even more benefits. Such as it offers you a predictable income, less volatility, fixed profit twice a year. On top of that, you’ll help your community (offices, schools, civil departments) to grow through buying bonds because they are similar to asking for debt which will be returned to you with profit.

How to diversify your bonds?

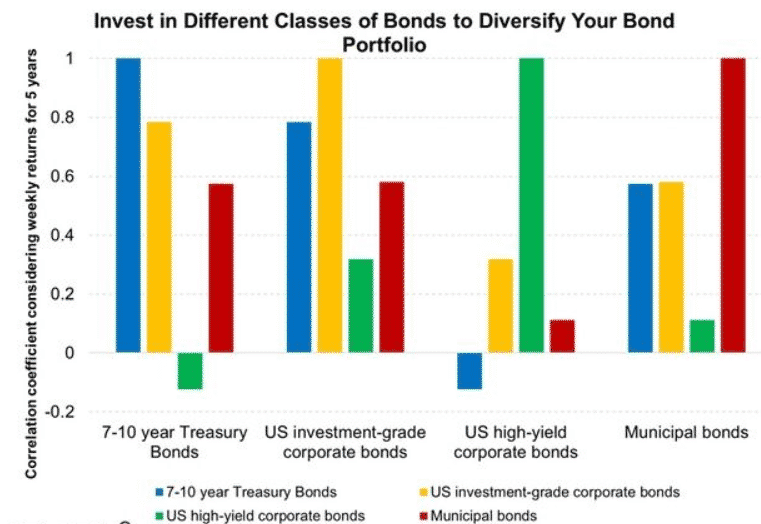

What do you think diversifying your bonds is about? No, it is not about quantity; rather, it’s about variety. While diversifying your portfolio, you don’t have to figure out the income or payout. Its purpose is safety. So, consider various categories. You can even invest in different asset classes like stocks or real estate.

Bonds aren’t traded publicly; you have to go through a broker. However, you don’t need to worry about the middleman as FINRA (Financial Industry Regulatory Authority) supervises the bond market by publishing transaction prices.

In diversification, there is a rule of thumb you should follow. According to this rule, subtract your age from 100 and invest in stocks while the other part is in bonds. So, for example, a 25 years old trader should invest 75% in stocks and 25% in bonds.

Easy steps to diversify your bonds

Are you interested in diversifying your bonds? Nope, there is no need to pay dollars to get your bonds diversified. Here we have enlisted five easy steps for you to follow.

Step 1. Select bonds

Select the best & the safest asset to buy. There are three major types of bonds.

- Corporate

With a high-profit rate.

- Municipal

Offered by states & cities.

- Treasury

Offered by the US government.

You should not buy the bonds with higher raters blindly. Instead, perform due diligence and select the most suitable alternative for any shock disruption in other investments.

Step 2. Research bonds

Don’t just go for one bond; study several bonds and buy many in different industries. Look up to the expert investors, observe their way of selection and investment. Then, consult an advisor to get the best out of it.

Step 3. Look after the trends

Interpret the trends carefully because past progress does not guarantee future profits. As you know, there is always flexibility of ups and downs in life. Therefore, actively monitor the fluctuations in each product you invested in.

Step 4. Buy bonds

Wait for the right time to buy these assets. We would recommend them when interest rates are low. It may seem unattractive to some investors out there, yet these assets yield more profit later.

Step 5. Select the right time to sell

After diversifying:

- Don’t sit back on your couch carelessly.

- Keep an eye on the market trends and their spikes of acceleration & retardation.

- Wait for the right time to sell a bond.

Yes, we know that you’re supposed to hold a bond until maturity to get your principal amount. However, you can sell it at any suitable time. There will be chances to get a premium cost when the interest rate is lower than you bought it.

Final thoughts

At the bottom line, you can say that diversification is the risk management of your investment. It can save you at the time of a traumatic loss in stock. When you cannot interpret things so actively, bond diversification will play a life savior role. Even at a young age, if someone cannot afford to lose their wealth, they should go for bond diversification.

Long story short, diversifying bonds can make your life easier by cutting off the vulnerability of your investment to loss. Moreover, diversification of bonds gives a sound output even in the unfortunate year of the trade market. So, mate, are you ready to diversify your bonds? You better be.