- What are blockchain stocks?

- Which are the top blockchain stocks to invest in?

- What potential do they hold in the upcoming future?

The tremendous rise in cryptocurrency prices brought blockchain stocks into the limelight last year. However, despite the current volatility of crypto assets, the vast majority have increased significantly over the previous year.

Musk’s statements have a significant impact on the market for virtual money. In response to more widespread media attention and celebrity tweets, the value of cryptos has soared. What are the best blockchain stocks to buy?

Best blockchain stocks to watch right now

Let’s go through a few of the top blockchain stocks to invest in this year.

Block Inc. (SQ)

We’ll begin with Block, which was formerly known as Square. It’s a financial services software start-up, to put it simply. These include Square, TIDAL, and Spiral, which provide technology enabling customers to access the economy through mobile devices. In addition, merchants may use the company’s technology to run and grow their businesses. Last month, the corporation’s name was changed to Block, indicating a shift focused on blockchain technology.

Why does it have the potential to grow?

Block announced that it would build a Bitcoin mining system and recruit a team. According to the company, mining is more than just a way to create new Bitcoins. A permissionless and completely decentralized future is also an important consideration. However, for the time being, mining seems to go place “out in the open and alongside the community.”

Thus, Block’s goal is to allow everyone to mine Bitcoin from their own home. This new effort demonstrates the company’s view that Bitcoin will eventually become the internet’s main currency. Do you believe SQ stock is a good investment in blockchain technology?

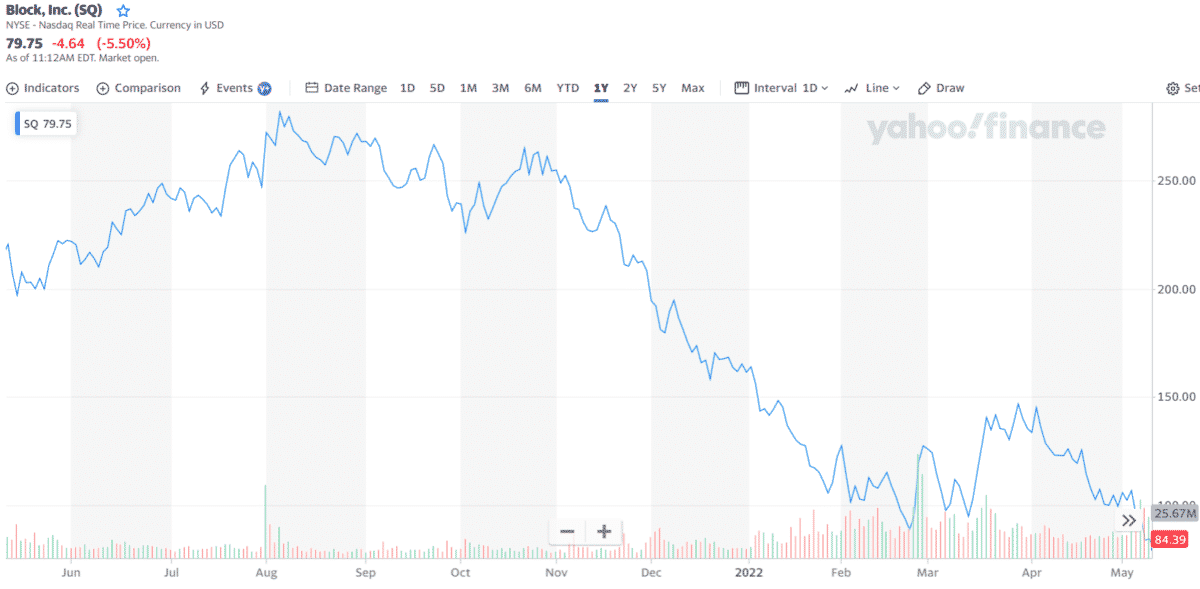

How much would you earn if you invested in SQ 1 year ago?

SQ’s share price on 11 May 2021 was $220.65. The stock’s share price closed at $79.48 a year later. So if you had invested $1,000 last year, your account could have lost $639.79.

Coinbase (COIN)

Financial technology company Coinbase is next. The company serves as a one-stop shop for everything related to financial technology and infrastructure. Cryptoeconomics is the primary purpose of this project. This fast-developing network has 43 million retail customers and 7,000 institutions, and 115,000 ecosystem partners in more than 100 countries, making it one of the largest in the world. Based on these numbers, Coinbase would be one of the world’s leading blockchain companies.

Why does it have the potential to grow?

Coinbase will acquire FairX, a cryptocurrency futures market. An essential step toward the company’s goal of making the derivatives market available to millions of American consumers. Commodity Futures Trading Commission oversees FairX, a company that sells futures products and was created last year (CFTC). Coinbase’s ability to trade crypto futures and options may attract institutional investors. As a consequence of this, would you add COIN stock to your stock watchlist?

How much would you earn if you invested in COIN 1 year ago?

COIN’s share price on 11 May 2021 was $303.00. The stock’s share price closed at $54.56 a year later. So if you had invested $1,000 last year, your account could have lost $819.93.

Silvergate Capital (SI)

Bank of America is a financial services provider for the fast-expanding digital currency industry for those who are not aware. Mortgage warehouse finance, commercial lending, and commercial banking are some of its offers. Silvergate Capital is an additional promising blockchain investment at the moment. In addition, it is a virtual-instantaneous payment network for digital currency sector participants, the Silvergate Exchange Network (SEN). Although the blockchain industry is currently unstable, SI stock has gained over 85% in the past year.

Why does it have the potential to grow?

Fintech companies, digital currencies, payments, and specialty finance technology focus on this joint investment firm. Therefore, it seeks investment opportunities to be utilized in the banking business. Additionally, investors will be eagerly awaiting the company’s fourth-quarter and year-end financial figures to be released. What are your thoughts on purchasing SI stock before the firm releases its earnings report?

How much would you earn if you invested in SI 1 year ago?

SI’s share price on 11 May 2021 was $85.10. The stock’s share price closed at $82.66 a year later. So if you had invested $1,000 last year, your account could have lost $28.67.

IBM Corp (IBM)

However, the stock of IBM, long the darling of the computer industry, has fallen precipitously in the last several years. In 2017, IBM launched the blockchain service to reposition itself as a leading blockchain technology solutions provider.

Why does it have the potential to grow?

According to the company’s current status, it is in charge of more than 500 blockchain initiatives on behalf of customers, including Kroger and Walmart. As a result, I believe IBM has a good chance of making money as more companies begin to embrace blockchain technology.

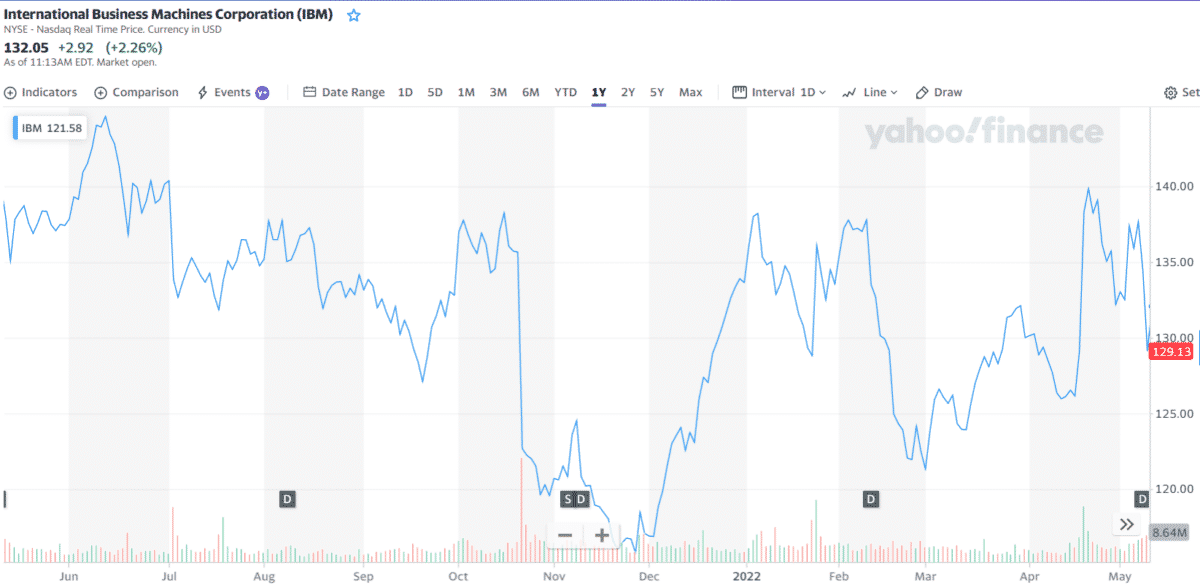

How much would you earn if you invested in IBM 1 year ago?

IMB’s share price on 11 May 2021 was $131.32. The stock’s share price closed at $131.75 a year later. So if you had invested $1,000 last year, your account could have gained $3.27.

Riot Blockchain (RIOT)

Riot Network is a Bitcoin mining company established in the United States that supports the Bitcoin network via large-scale mining operations. In addition, the company now develops energy-efficient mining processes, as seen by its acquisition of Texas’ 300 megawatts Whinston complex.

Why does it have the potential to grow?

According to some estimations, Riot Blockchain may produce up to 750 megawatts at around $0.025 per kilowatt-hour. As a result, bitcoin mining has never been more affordable, giving one company a leg up on its competitors in distributed ledger technology.

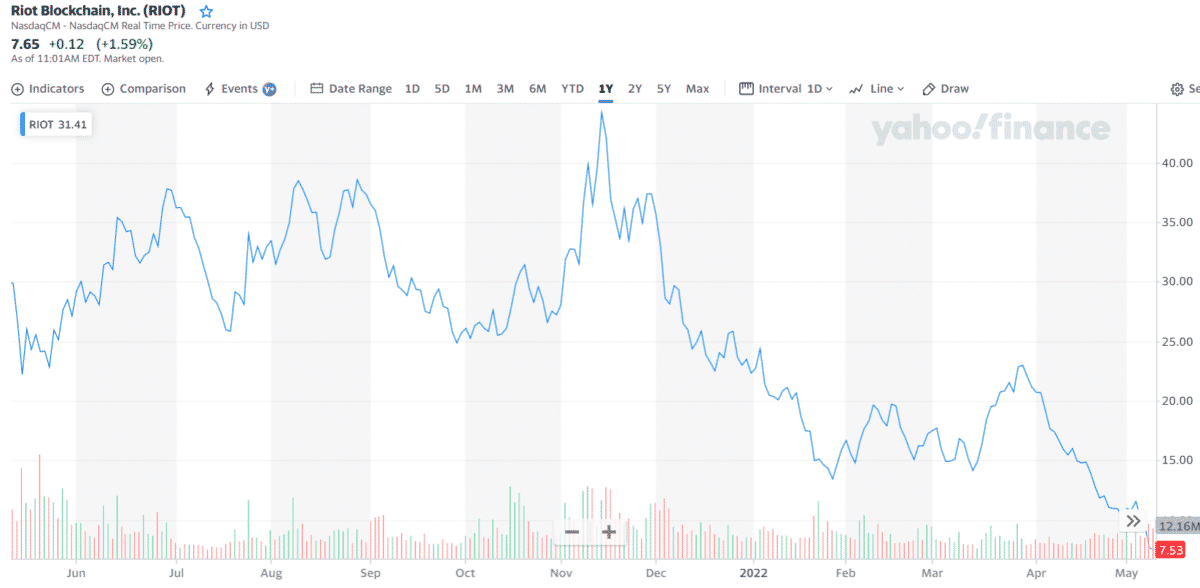

How much would you earn if you invested in RIOT 1 year ago?

RIOT’s share price on 11 May 2021 was $29.87. The stock’s share price closed at $7.70 a year later. So if you had invested $1,000 last year, your account could have lost $742.21.

Final thoughts

While blockchain technology is still in its early stages, it attracts investors’ interest. Few of the world’s most well-known firms have embraced the technology and are poised to be among the top blockchain stocks to watch this year. Finding firms that currently have a solid presence but might benefit from blockchain services could be a fun way to diversify your portfolio.